Date: November 18, 2018

Contact: mediacenter@freeandfairmarketsinitiative.org

While Amazon Reaps Billions From Taxpayers For HQ2, Many Of The Largest Companies In New York and Virginia Paid Double The Effective Federal Tax Rate Of Amazon

SHOT

New York and Virginia Were “Fleeced” Into Giving Amazon Billions For HQ2.

Amazon will reap enormous taxpayer-funded incentives to build its second corporate headquarters. Virginia offered Amazon a $573 million incentive package, while New York promised the company $1.525 billion in incentives, including $1.2 billion over the next ten years.

CHASER

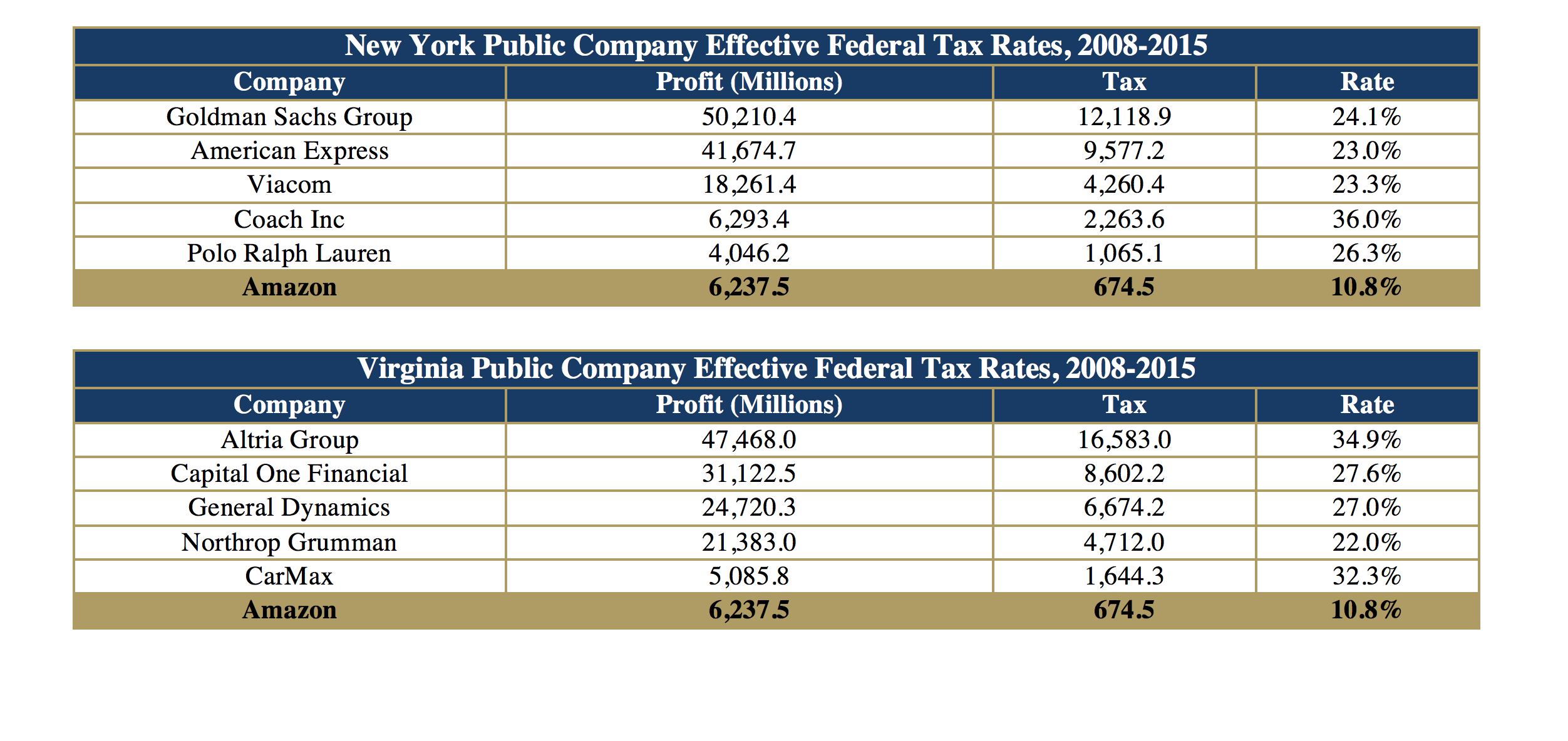

From 2008 to 2015, many of the largest companies in New York and Virginia paid more than double the effective federal tax rate of Amazon.

According to an analysis by the Institute on Taxation and Economic Policy, from 2008 to 2015, Amazon paid an effective federal corporate income tax rate of 10.8%– a rate that pales in comparison to what the largest companies in New York and Virginia pay.

Amazon’s ability to shelter its profits from federal income taxes reflects a trend that culminated in 2017, when the company reported $5.6 billion in US profits and paid zero federal income taxes, according to the ITEP.

(Institute on Taxation and Economic Policy, accessed 11/13/18; Newsday, accessed 11/13/18; Virginia Business, 3/16/16)

(Institute on Taxation and Economic Policy, accessed 11/13/18; Newsday, accessed 11/13/18; Virginia Business, 3/16/16)

ABOUT THE FREE & FAIR MARKETS INITIATIVE

The Free & Fair Markets Initiative (FFMI) is a non-profit coalition of businesses, consumer advocacy groups, workers and community activists committed to scrutinizing and highlighting emerging market trends that are stifling competition and innovation, influencing federal and local government spending, putting consumer data in harm’s way and limiting consumer choice. For a list of members, please visit https://freeandfairmarketsinitiative.org/about-us/members/. For more information on the Free & Fair Markets Initiative, please visit https://freeandfairmarketsinitiative.org.

To download a PDF of this, click HERE